Dear WuBookers, it wasn’t so long ago that we talked about visibility on Google and Google Hotel Ads, but something in the last few months has changed (and will change again). We are talking about the Digital Markets Acts (DMA), legislation introduced by the European Union to ensure a fairer digital marketplace. Among the measures included in the DMA is the regulation of the activity of so-called “gatekeepers,” which includes Google. But what does the DMA stipulate and what does it change for hotels and properties?

What is the Digital Markets Act and why it was introduced

The Digital Markets Act aims to make the digital world fairer and more open for the benefit of private and business users. To this end, it establishes a set of criteria and obligations aimed at identifying and regulating the work of “gatekeepers” (literally “gatekeepers”).

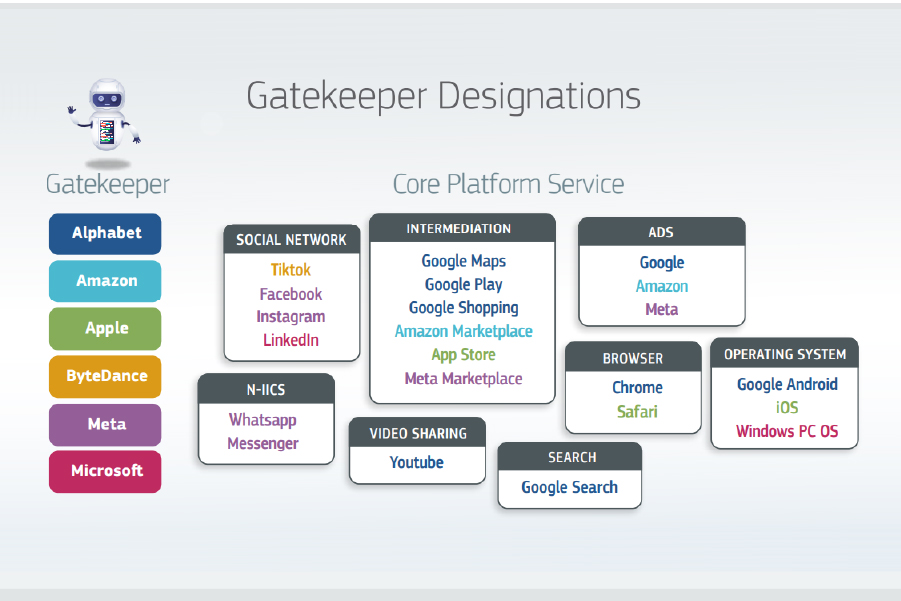

According to the EU, gatekeepers are large platforms that “exercise a gatekeeping function to control access” to online services, thereby limiting market fairness.

In September 2023, the EU identified 6 of them: Alphabet (Google’s parent company), Amazon, Apple, ByteDance (TikTok), Meta (Facebook), and Microsoft (Windows); and gave them 6 months to comply with the regulations.

In fact, the DMA prohibits:

- Favor their own products and services over those of competitors on the platform;

- Prevent users from making direct contact with companies outside the platform;

- Track users for advertising purposes without their explicit consent;

- Prevent users from uninstalling preinstalled applications or software.

The purpose is multi-faceted: to promote greater transparency and competitiveness by reducing unfair practices derived from market dominance, and to give consumers more opportunities and freedom of choice.

Thus, as of March 2024, Google has also adapted to the DMA by completely restructuring its hotel and flight search results page.

What has changed on Google Hotel Ads

To avoid favoring proprietary services such as Maps and Google Travel at the expense of others, Google has changed the way results are presented when searching for hotels online. In fact, the interface of Google Hotel Ads is very different from how it was until recently.

Let’s take an example by searching for the word “hotel” followed by the name of a location, such as “hotel copenaghen.”

Among other changes, we particularly note the presence of more filters in the top submenu, including the dates of stay, which are no longer visible at the top of the hotel listings, but must be selected specifically from here.

Also in this area are other entries, such as “Place Sites,” which opens a page of results with hotels derived primarily from OTAs, metamotors, and guides.

“Accommodation” instead provides access to a list of sponsored listings and property sites: clicking on a property’s price opens the related Google My Business tab.

The map is not immediately visible, but nested under “Information.” The same is true if you search for the property’s name online (example “hotel pincopallo copenaghen”): the My Business tab shows only a thumbnail of the map, not clickable. Even when you click on “Check Availability,” you are redirected to a results page and not to the Travel environment from which you can manage all the details.

All this implies extra steps for the user who wants to book, and instead finds himself having to perform many more actions than before, with the risk of becoming disoriented and lost, perhaps preferring Booking.com or other portals.

Reviews are also no longer derived only from Google but also collected from other sources, such as OTAs and metamotors, which can attract users and clicks.

What are the consequences for hotels and properties

Beyond the need to familiarize themselves, first and foremost as users, with the new approach, what are the practical consequences for hoteliers?

Some early research reveals a 30 percent drop in clicks on hotel sites and a 36 percent drop in direct reservations between January and April 2024.

At the moment, then, it seems that the ones who gain the most from this situation have been the OTAs, benefiting from a more complicated user experience on Google and their ability to spend on visibility and paid ads.

On the other hand, Google Hotel Ads has not disappeared among the investment options and therefore remains a valid tool within a property’s promotion strategy.

Then, the role of organic positioning (SEO) is confirmed, which continues to guarantee free visibility and consequently direct sales, provided the property is well structured and equipped with a reservation system (i.e., a booking engine).

In sum, the Digital Markets Act has messed up the logic we have become accustomed to, but it has also opened up new scenarios, especially considering the fact that it is still an evolving measure.

And what about Booking.com?

In May of this year, Booking.com was also added to the list of gatekeepers, and adjustments to the standards are expected in November. In the meantime, however, something has already moved since the “parity rate,” a mandatory requirement until recently to register with Booking.com and Expedia, has also been abolished at the European level.

To be fair, the measure had already been effective for years in Italy, but now it is being extended to other European entities as well.

In a nutshell, if properties were previously required to apply the same rates across all sales platforms, for the past few months they have been able to differentiate prices between distribution channels, including discounts and targeted promotions.

This could mean increased competition for Italian establishments, as international chains operating in Italy will also be able to adopt different pricing strategies.

The assumptions of the DMA are supportable and the consequences not entirely clear: all that remains is to follow its developments and take advantage of them as far as possible.